Boc central professional#

Post-certification coursework from a CAATE accredited athletic training post professional program

Live events and home study programs (workshops, seminars, conferences, webinars, etc.) To return to Certified status, AT must submit missing requirements and pay a $20 late fee by Feb. $20 if late in 2022 and $20 if late in 2023 = $40 in late fees)Ĭertification remains active, AT must submit missing requirements and pay a $20 late fee by Dec. *Late fees may be assessed for each year requirements are late (e.g. If above requirements not met by deadline: UPLOAD CURRENT EMERGENCY CARDIAC CARE (ECC) CARD/CERTIFICATE OR CONFIRM CURRENT ECC CERTIFICATIONģ. ATTEST TO COMPLIANCE WITH BOC STANDARDS OF PROFESSIONAL PRACTICEĢ.

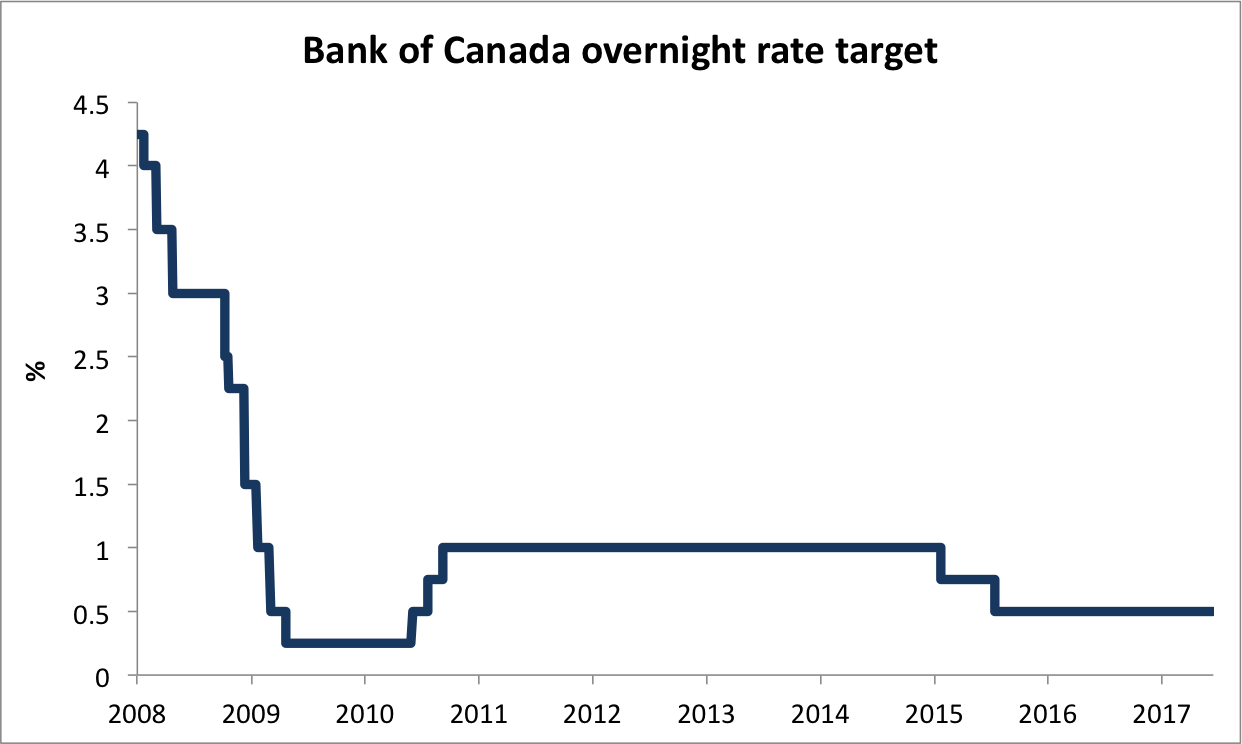

The current period ends December 31, 2023.ġ. CE programs must also be intended for credentialed health care providers and wellness professionals.ĪTs must complete a predetermined number of continuing education units (CEUs) during the certification maintenance period. They must focus on increasing knowledge, skills and abilities related to the practice of athletic training. CE requirements are intended to promote continued competence, development of current knowledge and skills and enhancement of professional skills and judgment. The BOC sets the national standards for certification and through our list of BOC Approved Providers, we offer tools to maintain your continuing education (CE). We are your partner in promoting excellence in practice throughout your career. “On the other hand, as we have previously pointed out, the built-in inertia of this metric does not readily reflect the current situation, which is actually starting to look better.”Īside from committing to a greater data focus, Ambler and Kronick urged the central bank to fixate less on headline inflation, and instead “use the more telling measures that exist.When an Athletic Trainer (AT) renews their national certification, it shows they value professional development, evidence based practice and are committed to the BOC mission of serving in public protection. “It is true that headline inflation still looks stubbornly high, at 6.8 percent in November,” they said. The central bank's pledge to rely more heavily on data, the two argued, is even more appropriate given its signals of an expected end to the tightening cycle. There are similar risks as interest rates increase on the tightening side, they added, as excessive forward guidance prompts excessive dampening economic activity dampening. While there was a need to deviate from that forward guidance, doing so jeopardizes the tool’s credibility, which the two said might have been part of the reason why the BoC held off on hiking rates.

“The Bank’s two calculated output-gap indicators remained negative at the end of the third quarter of 2022 (-2.1 and -0.4 percent),” they said. However, Ambler and Kronick said, this commitment hinged on the output gap, or the difference between the economy's actual and potential production. When headline inflation was still significantly below target two years ago at 0.7%, the Bank declared it would maintain the policy interest rate at the effective lower bound until the economy's excess slack is absorbed and the 2% inflation objective is stably attained. While people make spending decisions that hurt the economy and themselves because they believe the central bank will stay on its previously revealed course, forward guidance does not mean it will adhere to a fixed plan. While some people have not seen adjustments in their mortgages yet, the pinch will eventually come for them as well. Many Canadians who accepted the advice to take out mortgages at all-time low rates are now facing significantly higher borrowing costs. The two argued that attempt at forward guidance – when a central bank aims to provide predictability for individuals and organizations to confidently move forward with significant scheduled purchases and investments – only added to increasing inflation and an overheated economy that the central bank is now trying to cool. At the time, the BoC told Canadian consumers and companies that low interest rates would likely last for a very long time, hoping to increase demand and battle low inflation. As an example, Ambler and Kronick cited the second half of 20202, when the overnight rate was at its lower bound.

0 kommentar(er)

0 kommentar(er)